A Contract for Deed is used as owner financing for the purchase of real property. The Seller retains title to the property until an agreed amount is paid. After the agreed amount is paid, the Seller conveys the property to Buyer.

Law summary Free preview Contract Real Executory

Buyer's Request for Accounting from Seller under Contract for Deed

View this form Contract for Deed Seller's Annual Accounting StatementContract for Deed Seller's Annual Accounting Statement

View this form Assignment of Contract for Deed by SellerAssignment of Contract for Deed by Seller

View this form Notice of Assignment of Contract for DeedNotice of Assignment of Contract for Deed

View this form Residential Real Estate Sales Disclosure StatementResidential Real Estate Sales Disclosure Statement

View this form Lead Based Paint Disclosure for Sales TransactionLead Based Paint Disclosure for Sales Transaction

View this formThe work with papers isn't the most straightforward process, especially for those who almost never work with legal papers. That's why we recommend utilizing accurate Pennsylvania Agreement or Contract for Deed for Sale and Purchase of Real Estate a/k/a Land or Executory Contract templates made by skilled lawyers. It gives you the ability to prevent problems when in court or working with formal institutions. Find the documents you want on our site for top-quality forms and exact information.

If you’re a user with a US Legal Forms subscription, just log in your account. When you are in, the Download button will immediately appear on the template web page. Right after getting the sample, it’ll be saved in the My Forms menu.

Users with no a subscription can easily create an account. Follow this brief step-by-step guide to get your Pennsylvania Agreement or Contract for Deed for Sale and Purchase of Real Estate a/k/a Land or Executory Contract:

Right after completing these easy actions, you can fill out the form in your favorite editor. Recheck filled in info and consider asking a lawyer to examine your Pennsylvania Agreement or Contract for Deed for Sale and Purchase of Real Estate a/k/a Land or Executory Contract for correctness. With US Legal Forms, everything becomes much simpler. Test it now!

Contract Deed Real Aka Deed Aka Land Contract Purchase Executory Estate Aka Executory Contract Deed Aka Executory Application Contract Real A Deed Real Aka

A contract for deed is an agreement for buying property without going to a mortgage lender. The buyer agrees to pay the seller monthly payments, and the deed is turned over to the buyer when all payments have been made.

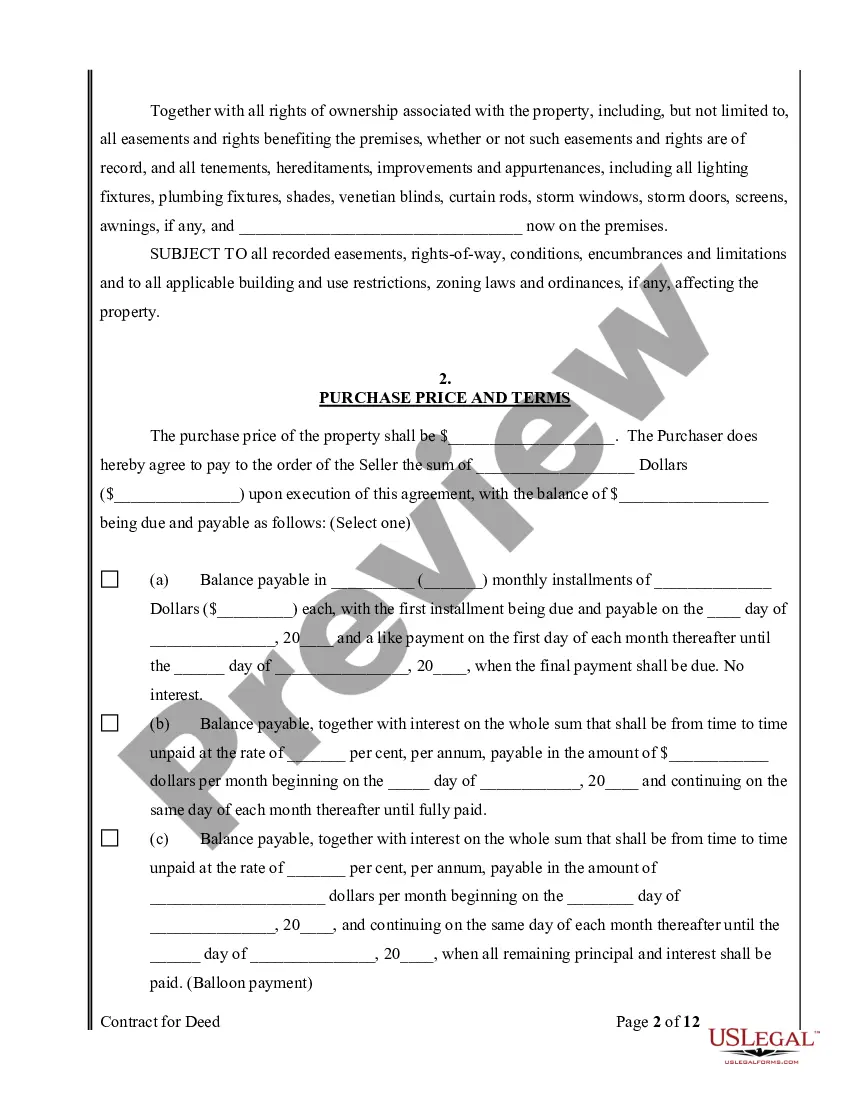

A disadvantage to the seller is that a contract for deed is frequently characterized by a low down payment and the purchase price is paid in installments instead of one lump sum. If a seller needs funds from the sale to buy another property, this would not be a beneficial method of selling real estate.

A contract for deed, also called a land contract or contract for sale, is a financing option for buyers who do not qualify for a mortgage loan to purchase property. In a contract for deed, the seller finances the purchase of the property, much like a mortgage company in a more traditional mortgage situation.

A disadvantage to the seller is that a contract for deed is frequently characterized by a low down payment and the purchase price is paid in installments instead of one lump sum.The legal fees and time frame for this process will be more extensive than a standard Power of Sale foreclosure.

A contract for deed, also known as a "bond for deed," "land contract," or "installment land contract," is a transaction in which the seller finances the sale of his or her own property. In a contract for deed sale, the buyer agrees to pay the purchase price of the property in monthly installments.

One of the biggest negatives that can occur with a land contract is when a buyer purchases a property on which the seller is still making mortgage payments.

A purchase agreement is also used in real estate transactions. The document used to purchase services is more often called a contract or service agreement. Although a purchase order, or PO, and a purchase agreement are both used to make purchases, they operate in different ways.

A contract for deed is a legal agreement for the sale of property in which a buyer takes possession and makes payments directly to the seller, but the seller holds the title until the full payment is made.

To change the state, select it from the list below and press Change state. Changing the state redirects you to another page.

Pennsylvania Change state Close No results found. Pennsylvania California Connecticut District of Columbia Massachusetts Mississippi New Hampshire New Jersey New Mexico North Carolina North Dakota Rhode Island South Carolina South Dakota Washington West Virginia Law summary Agreement or Contract for Deed for Sale and Purchase of Real Estate a/k/a Land or Executory ContractPENNSYLVANIA STATUTES

TITLE 68 REAL AND PERSONAL PROPERTY (P. S.)

CHAPTER 20 INSTALLMENT LAND CONTRACT LAW

68 P. S. § 902. Findings and declaration of policy

It is hereby determined and declared as a matter of legislative finding that:

(1) Since installment contracts are executory in nature and cover rights and obligations over an extended period of time prior to final settlement, it is deemed advisable to clarify and define the nature of the contract and the rights and obligations of both parties.

(2) It is the intent of this act to provide for an agreement that will be fair and equitable for both buyer and seller and will protect the buyer from unreasonable provisions pertaining to installment payments and to define what constitutes default and to provide remedies for the same and provide proper provisions for final settlement and delivery of good title to the purchaser.

(3) By reason of the fact that the installment sales agreement is executory in nature under its terms and final settlement is not contemplated for an extended period of time, the buyer is entitled to have full information and disclosure of the [FN1] terms of his agreement, the status of his account, the balance due on the purchase price and a statement of the application of his monthly installment with the proper itemization of what constitutes principal payments and carrying charges during the existence of the agreement.

68 P. S. § 903. Definitions; application of act

(a) As used in this act:

(1) "Installment land contract" includes every executory contract for the purchase and sale of a dwelling situate in any city of the first class or county of the second class whereby the purchaser is obligated to make six or more installment payments to the seller after the execution of the contract and before the time appointed for the conveyance of title to the dwelling.

(2) "Dwelling" means a building or structure situate in any city of the first class or county of the second class which is wholly or principally used for residential purposes.

(b) This act shall apply only to installment land contracts entered into after the effective date of this act and shall apply notwithstanding any provision of a contract inconsistent herewith.

(c) This act shall not apply to installment land contracts entered into in which the Administrator of Veteran Affairs, an officer of the United States, is the seller.

68 P. S. § 904. Notice to terminate contract upon purchaser's default

(a) Whenever default is made in the terms or conditions of any installment land contract by reason of which default the seller has the right to terminate the contract, the seller shall as a condition precedent to the exercise of the right serve upon the purchaser a written notice of termination. The notice shall be served personally by registered mail or by certified mail sent to the last known address of the purchaser.

(b) The notice shall specify the nature of the default and whenever the default arises out of the purchaser's failure to keep the premises in good repair pursuant to the provisions of the installment land contract, the notice shall contain a reasonably specific statement of the items in disrepair.

(c) The date of termination specified in the notice shall in no case be less than thirty days after the date upon which service of the notice is made upon the purchaser, in the manner hereinbefore provided, where default is because of failure to make payment when due. Whenever default arises because of purchaser's failure to make repairs, the notice shall be no less than sixty days.

68 P. S. § 905. Seller's remedies

(a) In the event of any default by the purchaser in the payment of any installment, any assessment for public improvements or any sum owed by the purchaser because of repairs made by the seller and payable by the purchaser pursuant to the terms of the contract, the remedies of the seller shall be limited to either:

(1) Termination of the contract in accordance with the provisions of section 4 of this act, or

(2) An action for the recovery of the installment, assessment or the expenditure for repairs made by the seller.

(b) Any seller who has pursued the remedies set forth in clause (2) above may at any subsequent time, unless the purchaser shall have cured any subsequently declared default, terminate the contract in accordance with the provisions of section 4 of this act. [FN1]

(c) In any action by a seller, pursuant to subsection (a), clause (2), above, recovery shall be limited to all installments and assessments for public improvements due prior to the surrender of the premises by the purchaser, and whenever the purchaser is responsible for repairs, the value of the repairs made by the seller prior to the surrender and the cost of any actual repairs made by the seller, subsequent to the surrender of the premises, which repairs become necessary by reason of damage done by the buyer or the vandalism of the premises prior to the actual delivery of possession to the seller.

(d) The seller upon termination of any installment land contract, may maintain an action for damages for breach of the contract as hereinafter provided, or an action for the recovery of possession of the property as now provided by law, or both.

(e) In any action by the seller to recover damages for a breach of any installment land contract, the seller shall be entitled to recover damages for all losses resulting from the breach, including but not limited to, the excess of the contract price over the market price at the time of breach, the unpaid installment payment due prior to the surrender of the dwelling by the purchaser, the value of repairs made by the seller prior to the surrender whenever the purchaser is responsible for the repairs, and the cost of any actual repairs made by the seller subsequent to the surrender of the premises which repairs become necessary by reason of damage done by the buyer or the vandalism of the premises prior to the actual delivery of possession to the seller, and any assessments for public improvements. The unpaid balance of the purchase price shall not be considered an item of recoverable damages.

68 P. S. § 906. Action maintainable by defaulting purchaser

(a) To the extent provided in subsection (b) of this section, any purchaser who has voluntarily surrendered possession of the premises may maintain an action to recover payments of principal made on the contract and assessments for public improvements paid by him without interest on the payments, less any damages sustained by the seller upon the purchaser's default and his termination of the contract by voluntary surrender of possession of the premises.

(b) If the purchaser paid on account of principal, a sum in excess of twenty-five percent of the purchase price, he shall be entitled to recover that portion in excess of twenty-five percent less any other actual damages, as is more specifically set forth in section 5, subsection (e) hereof [FN1] suffered and expenditures made by the seller for which the purchaser has assumed liability. That portion of the purchase price retained by the seller hereunder shall be considered as liquidated damages covering possible losses sustained for the breach of contract for use and occupancy and for depreciation and not as a penalty action by the purchaser, must be instituted within one year from the date of default and such right of action by the purchaser shall not be deemed a cloud on seller’s title, nor prevent seller from conveying a clear title because of the pendency of the action.

68 P. S. § 907. Implied covenants of the seller

(a) Any seller entering into an installment land contract shall impliedly covenant that:

(1) Subject to subsection (f) hereof, his title shall be good and marketable during the entire term of the contract, and

(2) Upon the purchaser’s written request at reasonable intervals, no oftener than once every six months, he shall (i) inform the purchaser in writing of the current unpaid balance of the purchase price, (ii) furnish the purchaser with a complete itemization of all components of all installment payments, and (iii) make available to the purchaser for his inspection all tax and insurance receipts for the premises and whenever the purchaser is responsible under the contract for repairs, all bills and receipts therefor.

Seller shall not require purchaser to make settlement until the principal balance has been reduced by payments on account thereof to a sum not more than seventy-five percent of the original principal set forth in the installment land contract, except if seller agrees to take purchaser’s purchase money mortgage for the full balance of the principal then due or secures a mortgage for the full balance of the principal then due from a third party, said mortgage to be payable within a term of not less than ten years.

(b) When any seller fails to perform any of the covenants set forth in subsection (a) hereof, the purchaser may:

(1) Terminate the contract, or

(2) So long as the seller’s default continues, remain in possession under the contract and tender to the seller each installment payment provided for by the contract, less that portion which is allocable to principal, when any seller refuses or neglects to disclose information pursuant to subsection (a), clause (2) hereof, the purchaser in making his tender may withhold from each installment payment, that portion which he in good faith estimates as allocable to principal, and when the seller’s default has been remedied the purchaser shall pay to the seller all sums withheld under this clause.

(c) A purchaser electing either of the remedies set forth in subsection (b) hereof, shall serve a written notice of his election upon the seller personally or by registered mail or other mail service, which results in the post office department making a record of delivery and the sender receiving a receipt signed by the addressee or his agent, evidencing delivery sent to his last known address and shall with reasonable particularity state the reason for his action and the remedy he has elected. The notice shall state that on a specified day, not less than sixty days after service of the notice, the contract shall terminate or that the purchaser shall commence withholding principal payments whichever is the case, unless prior thereto, the seller shall cure his default and advise the purchaser thereof in writing, delivered personally to the purchaser or by registered mail, sent to the last known address of the purchaser.

(d) Any purchaser not in default who has exercised his right to terminate the contract pursuant to subsections (b) and (c) hereof, and who has surrendered possession of the premises, may maintain an action to recover payments of principal made on the contract and assessment for public improvements paid by him without interest on any payments and other damages as the purchaser may have suffered.

(e) When the purchaser exercises the option set forth in subsection (b), clause (2) hereof, and continues to tender each installment payment pursuant thereto, this shall be deemed to be full performance under the contract until the time that default is cured. Unless the default is cured the seller shall have no right to terminate the contract or to maintain an action for the balance of any installment payment.

(f) For the purpose of this section, a title shall be deemed marketable even though there is a lien or encumbrance affecting it which can be extinguished by the payment of a definitely ascertainable sum not in excess of the unpaid balance of the purchase price.

(g) When any seller violates subsection (a) hereof, and the seller does not comply with subsection (a) hereof, within thirty days after written demand therefor by the purchaser, the purchaser may at any time thereafter terminate the contract on account of uncertainty and may recover from the seller all installment payments paid, less that portion allocable to taxes, water and sewer rent and insurance premiums and less the cost of repairs made by the seller if the purchaser is responsible under the contract for repairs.

68 P. S. § 908. Allocation of monthly payments

In determining what portion of the monthly installments shall be applied against principal on account of the purchase price, there shall first be deducted all items authorized under the agreement of sale, such as taxes, water and sewer rentals, interest on the unpaid balance of purchase price, cost of all insurance premiums, repairs and assessments authorized under the terms of the agreement and the net balance thereof shall be applied to principal.

68 P. S. § 909. Existing remedies of purchaser

The rights granted by this act to any purchaser under any installment land contract, shall be in addition to and not in derogation of any rights of a purchaser under existing law.

68 P. S. § 910. Incorporation into contracts

Sections 3, 4, 5, 6, 7, 8 and 9 of this act [FN1] shall be deemed to be a part of every installment land contract entered into after the effective date of this act and each seller shall incorporate those provisions into every contract.

68 P. S. § 911. Effective date

This act shall take effect immediately.

PENNSYLVANIA CASE LAW

Specific performance of a land sale contract is a valid remedy when the party with a duty to convey fails to do so, and when it is established that the parties intended that a specific tract of land be conveyed and the court can adequately determine its boundaries, thereby enabling the court to fashion the remedy. Turner v. Hostetler, 518 A.2d 833 (1986)

The Superior Court of Pennsylvania concludes that a real estate security transaction, such as a land installment contract, should not be denied treatment as a “residential mortgage” solely because the vendor retains legal title as security for payment of the contract price. Anderson Contracting Co. v. Daugherty, 417 A.2d 1227, (1979).

Where an agreement for the sale of land is signed the vendee/buyer of the land becomes the beneficial or equitable owner of the land as the result of the doctrine of equitable conversion. The vendor/seller retains a security interest for the purchase price and retains a security interest for the purchase price. Knight v. Knight, 49 Pa. D. & C.3d 511 (1988)

PENNSYLVANIA STATUTES

TITLE 68 REAL AND PERSONAL PROPERTY (P. S.)

CHAPTER 20 INSTALLMENT LAND CONTRACT LAW

68 P. S. § 902. Findings and declaration of policy

It is hereby determined and declared as a matter of legislative finding that:

(1) Since installment contracts are executory in nature and cover rights and obligations over an extended period of time prior to final settlement, it is deemed advisable to clarify and define the nature of the contract and the rights and obligations of both parties.

(2) It is the intent of this act to provide for an agreement that will be fair and equitable for both buyer and seller and will protect the buyer from unreasonable provisions pertaining to installment payments and to define what constitutes default and to provide remedies for the same and provide proper provisions for final settlement and delivery of good title to the purchaser.

(3) By reason of the fact that the installment sales agreement is executory in nature under its terms and final settlement is not contemplated for an extended period of time, the buyer is entitled to have full information and disclosure of the [FN1] terms of his agreement, the status of his account, the balance due on the purchase price and a statement of the application of his monthly installment with the proper itemization of what constitutes principal payments and carrying charges during the existence of the agreement.

68 P. S. § 903. Definitions; application of act

(a) As used in this act:

(1) "Installment land contract" includes every executory contract for the purchase and sale of a dwelling situate in any city of the first class or county of the second class whereby the purchaser is obligated to make six or more installment payments to the seller after the execution of the contract and before the time appointed for the conveyance of title to the dwelling.

(2) "Dwelling" means a building or structure situate in any city of the first class or county of the second class which is wholly or principally used for residential purposes.

(b) This act shall apply only to installment land contracts entered into after the effective date of this act and shall apply notwithstanding any provision of a contract inconsistent herewith.

(c) This act shall not apply to installment land contracts entered into in which the Administrator of Veteran Affairs, an officer of the United States, is the seller.

68 P. S. § 904. Notice to terminate contract upon purchaser's default

(a) Whenever default is made in the terms or conditions of any installment land contract by reason of which default the seller has the right to terminate the contract, the seller shall as a condition precedent to the exercise of the right serve upon the purchaser a written notice of termination. The notice shall be served personally by registered mail or by certified mail sent to the last known address of the purchaser.

(b) The notice shall specify the nature of the default and whenever the default arises out of the purchaser's failure to keep the premises in good repair pursuant to the provisions of the installment land contract, the notice shall contain a reasonably specific statement of the items in disrepair.

(c) The date of termination specified in the notice shall in no case be less than thirty days after the date upon which service of the notice is made upon the purchaser, in the manner hereinbefore provided, where default is because of failure to make payment when due. Whenever default arises because of purchaser's failure to make repairs, the notice shall be no less than sixty days.

68 P. S. § 905. Seller's remedies

(a) In the event of any default by the purchaser in the payment of any installment, any assessment for public improvements or any sum owed by the purchaser because of repairs made by the seller and payable by the purchaser pursuant to the terms of the contract, the remedies of the seller shall be limited to either:

(1) Termination of the contract in accordance with the provisions of section 4 of this act, or

(2) An action for the recovery of the installment, assessment or the expenditure for repairs made by the seller.

(b) Any seller who has pursued the remedies set forth in clause (2) above may at any subsequent time, unless the purchaser shall have cured any subsequently declared default, terminate the contract in accordance with the provisions of section 4 of this act. [FN1]

(c) In any action by a seller, pursuant to subsection (a), clause (2), above, recovery shall be limited to all installments and assessments for public improvements due prior to the surrender of the premises by the purchaser, and whenever the purchaser is responsible for repairs, the value of the repairs made by the seller prior to the surrender and the cost of any actual repairs made by the seller, subsequent to the surrender of the premises, which repairs become necessary by reason of damage done by the buyer or the vandalism of the premises prior to the actual delivery of possession to the seller.

(d) The seller upon termination of any installment land contract, may maintain an action for damages for breach of the contract as hereinafter provided, or an action for the recovery of possession of the property as now provided by law, or both.

(e) In any action by the seller to recover damages for a breach of any installment land contract, the seller shall be entitled to recover damages for all losses resulting from the breach, including but not limited to, the excess of the contract price over the market price at the time of breach, the unpaid installment payment due prior to the surrender of the dwelling by the purchaser, the value of repairs made by the seller prior to the surrender whenever the purchaser is responsible for the repairs, and the cost of any actual repairs made by the seller subsequent to the surrender of the premises which repairs become necessary by reason of damage done by the buyer or the vandalism of the premises prior to the actual delivery of possession to the seller, and any assessments for public improvements. The unpaid balance of the purchase price shall not be considered an item of recoverable damages.

68 P. S. § 906. Action maintainable by defaulting purchaser

(a) To the extent provided in subsection (b) of this section, any purchaser who has voluntarily surrendered possession of the premises may maintain an action to recover payments of principal made on the contract and assessments for public improvements paid by him without interest on the payments, less any damages sustained by the seller upon the purchaser's default and his termination of the contract by voluntary surrender of possession of the premises.

(b) If the purchaser paid on account of principal, a sum in excess of twenty-five percent of the purchase price, he shall be entitled to recover that portion in excess of twenty-five percent less any other actual damages, as is more specifically set forth in section 5, subsection (e) hereof [FN1] suffered and expenditures made by the seller for which the purchaser has assumed liability. That portion of the purchase price retained by the seller hereunder shall be considered as liquidated damages covering possible losses sustained for the breach of contract for use and occupancy and for depreciation and not as a penalty action by the purchaser, must be instituted within one year from the date of default and such right of action by the purchaser shall not be deemed a cloud on seller’s title, nor prevent seller from conveying a clear title because of the pendency of the action.

68 P. S. § 907. Implied covenants of the seller

(a) Any seller entering into an installment land contract shall impliedly covenant that:

(1) Subject to subsection (f) hereof, his title shall be good and marketable during the entire term of the contract, and

(2) Upon the purchaser’s written request at reasonable intervals, no oftener than once every six months, he shall (i) inform the purchaser in writing of the current unpaid balance of the purchase price, (ii) furnish the purchaser with a complete itemization of all components of all installment payments, and (iii) make available to the purchaser for his inspection all tax and insurance receipts for the premises and whenever the purchaser is responsible under the contract for repairs, all bills and receipts therefor.

Seller shall not require purchaser to make settlement until the principal balance has been reduced by payments on account thereof to a sum not more than seventy-five percent of the original principal set forth in the installment land contract, except if seller agrees to take purchaser’s purchase money mortgage for the full balance of the principal then due or secures a mortgage for the full balance of the principal then due from a third party, said mortgage to be payable within a term of not less than ten years.

(b) When any seller fails to perform any of the covenants set forth in subsection (a) hereof, the purchaser may:

(1) Terminate the contract, or

(2) So long as the seller’s default continues, remain in possession under the contract and tender to the seller each installment payment provided for by the contract, less that portion which is allocable to principal, when any seller refuses or neglects to disclose information pursuant to subsection (a), clause (2) hereof, the purchaser in making his tender may withhold from each installment payment, that portion which he in good faith estimates as allocable to principal, and when the seller’s default has been remedied the purchaser shall pay to the seller all sums withheld under this clause.

(c) A purchaser electing either of the remedies set forth in subsection (b) hereof, shall serve a written notice of his election upon the seller personally or by registered mail or other mail service, which results in the post office department making a record of delivery and the sender receiving a receipt signed by the addressee or his agent, evidencing delivery sent to his last known address and shall with reasonable particularity state the reason for his action and the remedy he has elected. The notice shall state that on a specified day, not less than sixty days after service of the notice, the contract shall terminate or that the purchaser shall commence withholding principal payments whichever is the case, unless prior thereto, the seller shall cure his default and advise the purchaser thereof in writing, delivered personally to the purchaser or by registered mail, sent to the last known address of the purchaser.

(d) Any purchaser not in default who has exercised his right to terminate the contract pursuant to subsections (b) and (c) hereof, and who has surrendered possession of the premises, may maintain an action to recover payments of principal made on the contract and assessment for public improvements paid by him without interest on any payments and other damages as the purchaser may have suffered.

(e) When the purchaser exercises the option set forth in subsection (b), clause (2) hereof, and continues to tender each installment payment pursuant thereto, this shall be deemed to be full performance under the contract until the time that default is cured. Unless the default is cured the seller shall have no right to terminate the contract or to maintain an action for the balance of any installment payment.

(f) For the purpose of this section, a title shall be deemed marketable even though there is a lien or encumbrance affecting it which can be extinguished by the payment of a definitely ascertainable sum not in excess of the unpaid balance of the purchase price.

(g) When any seller violates subsection (a) hereof, and the seller does not comply with subsection (a) hereof, within thirty days after written demand therefor by the purchaser, the purchaser may at any time thereafter terminate the contract on account of uncertainty and may recover from the seller all installment payments paid, less that portion allocable to taxes, water and sewer rent and insurance premiums and less the cost of repairs made by the seller if the purchaser is responsible under the contract for repairs.

68 P. S. § 908. Allocation of monthly payments

In determining what portion of the monthly installments shall be applied against principal on account of the purchase price, there shall first be deducted all items authorized under the agreement of sale, such as taxes, water and sewer rentals, interest on the unpaid balance of purchase price, cost of all insurance premiums, repairs and assessments authorized under the terms of the agreement and the net balance thereof shall be applied to principal.

68 P. S. § 909. Existing remedies of purchaser

The rights granted by this act to any purchaser under any installment land contract, shall be in addition to and not in derogation of any rights of a purchaser under existing law.

68 P. S. § 910. Incorporation into contracts

Sections 3, 4, 5, 6, 7, 8 and 9 of this act [FN1] shall be deemed to be a part of every installment land contract entered into after the effective date of this act and each seller shall incorporate those provisions into every contract.

68 P. S. § 911. Effective date

This act shall take effect immediately.

PENNSYLVANIA CASE LAW

Specific performance of a land sale contract is a valid remedy when the party with a duty to convey fails to do so, and when it is established that the parties intended that a specific tract of land be conveyed and the court can adequately determine its boundaries, thereby enabling the court to fashion the remedy. Turner v. Hostetler, 518 A.2d 833 (1986)

The Superior Court of Pennsylvania concludes that a real estate security transaction, such as a land installment contract, should not be denied treatment as a “residential mortgage” solely because the vendor retains legal title as security for payment of the contract price. Anderson Contracting Co. v. Daugherty, 417 A.2d 1227, (1979).

Where an agreement for the sale of land is signed the vendee/buyer of the land becomes the beneficial or equitable owner of the land as the result of the doctrine of equitable conversion. The vendor/seller retains a security interest for the purchase price and retains a security interest for the purchase price. Knight v. Knight, 49 Pa. D. & C.3d 511 (1988)